Bitcoin: We’re on record.. and glad of it.

- Global-Investor

- Mar 5, 2024

- 4 min read

Updated: Mar 8, 2024

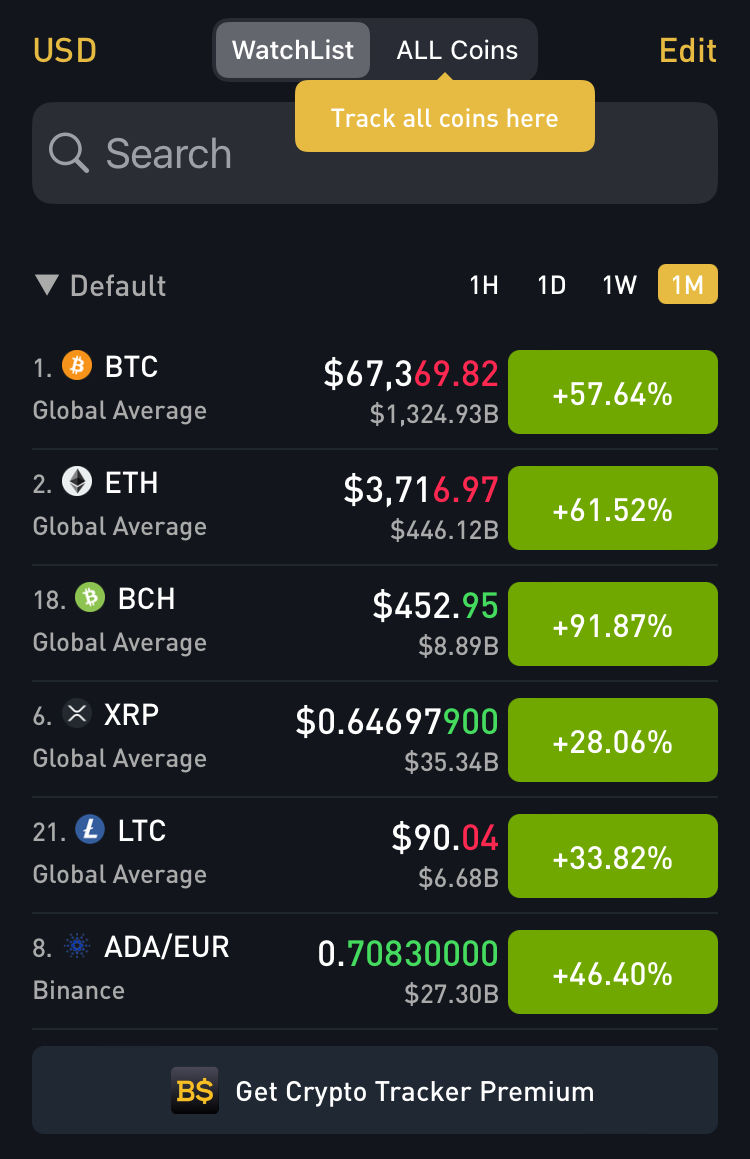

UPDATE: You might recall that on the 15th of June 2022, when the “sensible finance world“ was again pouring scorn on cryptocurrencies, and specifically bitcoin, I decided to finally put my money where my mouth was, and buy 10 of them. At under USD$20,000. Well, they’re now worth well over USD$60,000 each.

I shared all this with you at the time, via an email update to our client base, and a blog post because I was getting sick of hearing the nonsense from all the talking heads, smugly preaching that anyone who had shown any interest in these new currencies, or the crypto industry as a whole, was effectively a moron.

Back then, the value then had just gone below USD$20,000, and many men smarter than me were saying it would likely never recover. The great bubble had burst, the mighty scam uncovered.

The continual, and in my opinion, inevitable rise however is shown below. But let me tell you WHY, I felt so strongly that I bet the farm.

As I’ve said publicly several times (and fortunately each time it holds up), I don’t personally think the crypto market is a scam. It contains scams, certainly. But in and of itself, is not a scam.

Besides, name an industry that doesn’t contain scams. Real Estate? Banking? The art world? What about Bond Trading, or Equities? Any market can be manipulated by bad actors. Think GFC and Goldman Sachs. And of course, the many other “major firms” that wrote trillions of dollars off everybody’s balance sheet.

Compared to that, I feel, the fluctuations we have seen in major cryptocurrencies are minor, and I would say, almost “safe” by comparison. Perhaps that’s why these new asset classes have defied all predictions by staying relevant, and in fact, by gaining massive popularity, year on year.

The fact is, like many conservative investment networks, we don’t like taking risks, likewise we don’t get paid for losing our clients money. Or repeatedly giving bad advice.

It wasn’t easy then to recommend the purchase of a Bitcoin in 2022. But I genuinely felt that if you drilled down into the worlds’ “major currencies” you’ll find they’re a little more than virtual assets now themselves anyway. The commodities markets are manipulated by sovereign wealth funds, and Wall Street is, well….Need I say more? Investing can be a little like picking the friendliest shark to swim with.

Perhaps the market agrees with me, and that helps drive the popularity we’re seeing now in a new method of payment, a new underlying technology being developed to make those payments more transparent, and assets more secure, through the use of the underlying Blockchain technology that powers cryptocurrencies.

My logic then at the time was simple, and I still think sound. It’s the technology I’m backing. the Blockchain, and the people that want a better way to record and store value. ONE expression of that movement are the currencies built on that Blockchain.

So I backed the currency, to back the movement.

But I’m not that brave really, to me, the fact that this new “virtual asset” was “only” valued at 20,000 times more than the US dollar, was proof positive to me that there was/is something happening in the finance world that couldn’t be ignored. And I wasn’t going to miss out.

To date I’ve made, on the record, over USD$400,000 in profit. If I cash out. Which I’m not going to any time soon. The logic remains solid I think, so to then does the value in the original investment.

Fast forward now to March, 2024 and almost all of the top Crypto Currencies are in the green, and again rising to previous levels, AND new highs.

Why? Well, I think it’s simple. We’re not as dumb as we look. I think there’s been so much misinformation about the blockchain as a technology, and cryptocurrencies as a method of payment, that the “average” investor has spoken. We don’t buy it. We know what the institutions, and the smart money are doing. They’re buying big on cryptocurrencies (as recent price rises show), while backing the technology behind them in any way they can. All while lobbying government to restrict access and prevent the democratisation of a whole industry.

They claim we need “more regulation” to “protect” investors. Perhaps the market feels they need less regulation to enable investors. To open the market to a free economy. Perhaps that’s the philosophical war that’s being waged in closed committees and board rooms around the world.

A story on Reuters today titled “Bitcoin surges past $68,000, in sight of record high” - explains clearly how these institutional investors, major banks and funds have all been buying these asset classes again in recent months, often while publicly criticising them, thus driving their prices higher than ever. It’s a race against time, a virtual gold rush and personally, I don’t think they’re playing fair. But at least now, I own a shovel.

For those of you that have written to thank me for the advice at the time, or the others that simply acted quietly (and perhaps bravely) on their own… You’re welcome.

….But don’t blame me when they all take a serious tumble again. This is a long term hold in my opinion. Speculation is for those much braver than me.

Comments